Everywhere you turn in 2025, banks are chasing your attention with flashy ads about the best credit cards. Maybe you’ve seen them — “Get free movie tickets,” “Earn air miles,” or “Cashback on every purchase.” Scroll through Instagram or YouTube, and it almost feels like life gets easier the moment you swipe a shiny new card.

But let’s be honest — a credit card isn’t some magical ticket to wealth or luxury. It’s just a tool. And like fire, it can either keep you warm or burn everything down.

On richerthanyesterday.com, I always remind readers that money itself is neutral. It’s the choices we make that decide the outcome. Credit cards are a perfect example of this. Use them with discipline, and they’ll reward you with points, help you track expenses, and even boost your credit score. But lose control, and suddenly the best credit cards turn into the fastest road to high interest rates, mounting bills, and sleepless nights.

So before you sign up for another “too-good-to-be-true” deal in 2025, let’s slow down and really talk about it. Why do people actually need credit cards? What benefits are real and which ones are just marketing tricks? And most importantly, how can you make sure a card works for you, not against you?

Why People Need Credit Cards in 2025

Let’s be real — a credit card today isn’t just a shiny piece of plastic you keep in your wallet. In 2025, it’s become one of those everyday tools you can hardly live without. Think about it: traveling abroad without a card, or trying to shop online with only cash, sounds almost impossible. What used to feel like a luxury has quietly turned into a practical necessity.

The first reason is obvious — convenience. The best credit cards in 2025 save you from carrying cash everywhere. Whether you’re buying groceries, booking train tickets, or shopping on an international website, a quick swipe (or tap on your phone) does the job in seconds. With mobile apps and wallets linked to credit cards, paying has never been smoother.

But here’s something people often forget: your credit card isn’t just about spending, it’s about your financial reputation. Every bill you pay on time adds to your credit score — your financial “report card.” A strong score makes it easier to get loans, buy a house, or even grab lower interest rates. In short, using a card wisely today sets up your money future tomorrow.

Credit cards also shine when life throws you a curveball. Hospital bills, urgent car repairs, or sudden travel costs can wreck your monthly budget. That’s when a card becomes a lifeline — giving you breathing space without immediately dipping into your savings. It’s not free money, of course, but it buys you valuable time.

Then come the rewards. Banks compete hard to make their cards stand out, and the best reward credit cards in 2025 come with everything from cashback on groceries to free flight miles. Used carefully, these perks aren’t just gimmicks — they can save you real money. Travelers especially love cards that unlock lounge access or flight upgrades, making trips feel far less stressful.

And finally, there’s security. Carrying cash is always risky. If it’s lost, it’s gone. But with credit cards, you’ve got fraud protection, dispute systems, and even purchase insurance on your side. If someone makes unauthorized charges, the bank usually sorts it out fast — keeping you safer than you’d ever be with cash in hand.

The Benefits of Using Credit Cards Smartly

Used carelessly, a credit card can get you into trouble. But used wisely? The benefits are hard to ignore. One of the biggest perks is how it helps with cash flow management. Most banks give you up to 45 days of interest-free credit. That means you can swipe your card today, but as long as you clear the bill on time, you pay nothing extra. For anyone juggling bills or dealing with irregular income, this flexibility is a lifesaver.

The best credit cards in 2025 also open the door to lifestyle upgrades. Ever noticed those ads about dining discounts, free hotel stays, or airport lounge access? They’re real — if you play the game right. A travel credit card in 2025 that gives you flight miles, lounge access, and even travel insurance can turn stressful trips into smoother, more affordable experiences.

Now, some experts say credit cards encourage overspending. And yes, if you treat them like free money, they absolutely will. But here’s the flip side: when used with discipline, they actually improve financial habits. Every month, you get a detailed statement showing exactly where your money went. That visibility often pushes people to budget better and cut wasteful expenses. In fact, paying off a reward credit card in full each month can build both discipline and confidence with money.

Another huge plus is global acceptance. Whether you’re in the U.S., the U.K., Canada, India, or halfway across the world, the best credit cards in 2025 work almost everywhere. For frequent travelers, this makes them not just convenient, but essential.

And then there’s the underrated benefit: the emergency cushion. Imagine you suddenly need to cover hospital bills, car repairs, or last-minute travel. Instead of breaking into your savings or selling off investments at the wrong time, a card buys you breathing space. You handle the emergency now, and pay it back in a structured way later — while your long-term investments keep growing quietly in the background.

Eligibility for Credit Cards in 2025

Before applying for the best credit cards in 2025, it’s important to understand the basic eligibility criteria. Banks and financial institutions generally look at three key factors: age, income, and credit history. Most issuers require you to be at least 18 years old, though some premium cards may set the minimum age at 21. A steady source of income is equally important because lenders want assurance that you can repay your dues.

Your credit score plays a big role as well. A score above 700 usually improves your chances of approval and can even unlock better reward credit cards or lower interest rates. That said, beginners with no credit history can still qualify for entry-level or secured credit cards.

Ultimately, eligibility is about proving financial responsibility. If you can show stability and discipline, you’ll likely find a card that matches your lifestyle and spending habits.

The Hidden Traps and Risks of Credit Cards

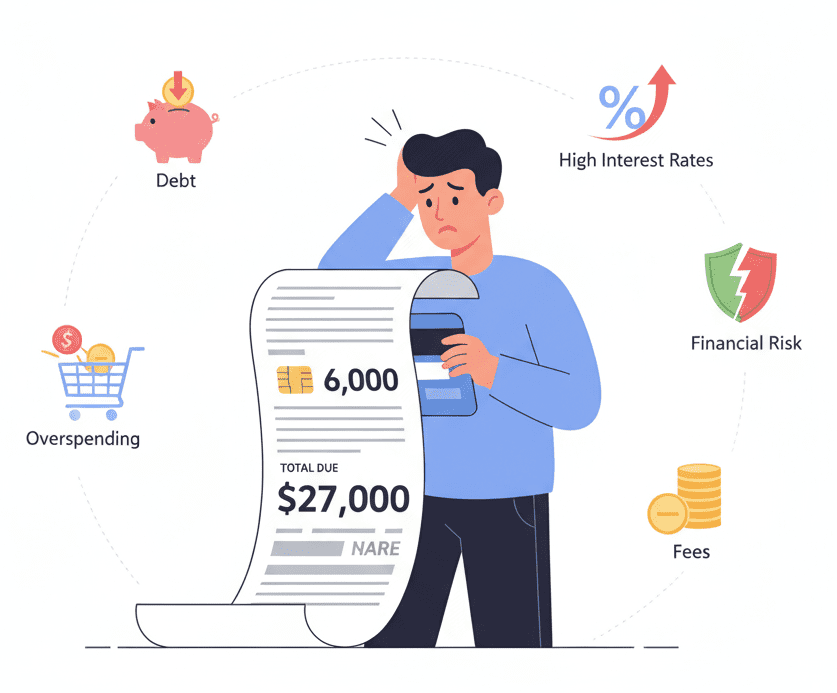

Now, let’s be real — credit cards aren’t all sunshine and reward points. They carry some very real risks, especially if you don’t use them wisely. The biggest trap? High interest rates. If you miss payments, interest can shoot up to 35–40% a year. That tiny balance you thought you’d clear “next month” can suddenly double or triple, turning into a serious debt spiral.

The danger gets worse with the “minimum due” trick. Banks make it sound easy — just pay a small amount and you’re fine. But here’s the catch: that payment usually goes toward fees and interest, not your actual balance. Meanwhile, the real debt keeps piling up quietly in the background. Plenty of people who happily signed up for the best credit cards in 2025 have ended up regretting it because they underestimated how fast debt grows.

Then there’s overspending. Swiping a card feels so effortless that it’s easy to forget you’re spending real money. Add in tempting reward credit card offers 2025 like cashback and discounts, and suddenly you’re buying things you never planned for. That thrill doesn’t last long — but the bill does. Over time, this habit can wreck your financial stability.

Credit scores can also take a hit. Late payments, crossing your limit, or defaulting altogether can leave scars on your credit report. The irony? The same best reward credit card 2025 that could’ve boosted your creditworthiness ends up damaging it if handled carelessly.

And don’t forget the fine print. Annual fees, late fees, processing charges, and foreign transaction costs lurk quietly until they show up on your statement. Many users realize too late that the “free” or “low-cost” card they signed up for actually costs a lot more. Choosing the wrong best credit card in 2025 without checking terms carefully can burn a big hole in your pocket.

Balancing the Pros and Cons

At the end of the day, a credit card is just a tool. Think of it like fire — it can cook your meal or burn down your house. The difference lies in how you use it. The same goes for the best credit cards in 2025. They’re not automatically good or bad; they simply reflect your money habits.

If you want your card to work for you (and not against you), discipline is non-negotiable. The golden rule? Pay your bills in full and always on time. That way, you enjoy up to 45 days of free credit without paying a single rupee or dollar in interest. And while reward points are fun, don’t fall for them blindly — never buy something just to chase cashback or freebies.

Keeping your credit utilization under 30% is another smart move. This shows lenders you’re responsible and protects your credit score. When choosing a card, pick one that fits your lifestyle. A travel credit card 2025 makes sense if you’re always flying, while a best reward credit card 2025 works better for everyday groceries, fuel, or shopping. For those carrying balances, a balance transfer credit card 2025 could be a lifesaver.

Finally, don’t ignore your monthly statements. They’re like a financial diary — showing hidden charges, duplicate swipes, or even fraudulent activity. By reviewing them carefully, you stay in control instead of letting the card control you.

Used this way, credit cards stop being a debt trap and start becoming what they’re meant to be: a flexible, secure, and rewarding financial tool that makes life easier.

Conclusion

As 2025 unfolds, credit cards continue to stand out as one of the most versatile financial tools we have. They can smooth out cash flow, open doors to travel perks, build your credit score, and even put money back in your pocket through rewards. Yet, the same card can also turn into a burden if it leads to overspending or high-interest debt.

The reality is simple: a credit card itself is neutral — it’s your habits that decide whether it supports your financial journey or slows it down. When you pay bills on time, avoid chasing rewards at the cost of unnecessary spending, and keep your usage under control, the best credit cards in 2025 can genuinely work in your favor. But if you treat it carelessly, it may trap you in cycles that delay your financial goals.

On richerthanyesterday.com, I always say that wealth isn’t just about how much you earn — it’s about how smartly you manage what you already have. Credit cards are the perfect example of this. Handle them wisely, and you’ll find that even a simple piece of plastic can become a powerful ally in shaping your financial future.

Why Some People Keep Getting Richer Than You in 2025

Have you ever scrolled through Instagram or LinkedIn and thought, “Why do some people always…

Buying a Car at the Wrong Time? Avoid This Costly Mistake in 2025

The Hidden Cost of Car Ownership Buying a car feels like a big moment. It’s…

Renting vs Buying a House with EMI: Wealth Choices for 2025

A house has always meant more than just four walls — it’s a symbol of…

Best Credit Cards in 2025: The Shocking Truth Banks Don’t Want You to Know

Everywhere you turn in 2025, banks are chasing your attention with flashy ads about the…

How Term Insurance Builds Millionaire Wealth in 2025

Introduction When most people talk about becoming rich, they instantly think of investments — stocks,…

Why Skipping Health Insurance Could Ruin Your Life in 2025– Global Healthcare Costs & Protection

Introduction I’ll be honest with you—I used to think health insurance was a scam. Every…