- Why Save ₹10000 per Month Actually Matters

- Step 1: Track Your Income and Expenses (The Foundation)

- Step 2: Use the 50-30-20 Rule with an Indian Twist

- Step 3: Slash Food & Grocery Expenses Without Feeling Deprived

- Step 4: Housing and Rent Hacks

- Step 5: Smarter Transport Choices

- Step 6: Control Lifestyle Spending (Entertainment, Shopping & Subscriptions)

- Step 7: Handle Indian Social Obligations Smartly

- Step 8: Automate Your Savings

- Real-Life Example: Salaried Employee in Bangalore

- Psychological Hacks to Stay Consistent

Why Save ₹10000 per Month Actually Matters

I’ll be real with you — saving ₹10,000 every single month feels tough at first. The moment salary comes in, rent goes out, then groceries, electricity, phone recharge, and suddenly Zomato tempts you at midnight. Before you know it, your bank balance looks like it’s on a diet.

But here’s the truth: if you manage to save ₹10000 per month even on a tight income, it completely changes the game. In one year, that’s ₹1.2 lakh sitting with you — and trust me, that’s not small money. With that amount, you can do a lot — maybe clear off a loan that’s been bothering you, keep some aside for emergencies, or put it into an investment and watch it quietly grow.

What I realised is this: saving isn’t just about stacking cash or seeing numbers in your bank account. It’s not just numbers in the bank it’s kind of a freedom thing for me. That ₹10,000 gives you choices — whether it’s peace of mind, a trip you’ve been craving, or helping your family when they need it.

You don’t have to borrow when something urgent comes up. You don’t feel guilty booking a quick train ticket to visit your parents. And here’s the best part — you’ll feel like you’re finally driving your money, instead of being dragged around by it.

So, how to save ₹10000 per month, budgeting, smart spending, and savings can actually be possible in daily life?

Step 1: Track Your Income and Expenses (The Foundation)

When I first started saving, I realised one thing – what isn’t measured can never be managed. If you don’t know where your money is going, you’ll always feel like it’s slipping through your fingers. The first step I took was tracking every single rupee I spent.

You don’t need fancy tools – I used a simple Google Sheet at the beginning, but you can also try free Indian apps like Walnut, Money View, or Goodbudget. The key is to break your expenses into categories: rent, groceries, food, transport, entertainment, subscriptions, and that random “miscellaneous” bucket.

What shocked me the most was the small leaks. A Zomato order here, an Amazon “deal” there, or daily cab rides… all these added up to an easy ₹2,000–₹3,000 a month. Even a ₹10 cutting chai counts. I actually tracked one full week of my spending, down to the tiniest expense, and just that awareness pushed me to cut waste.

Step 2: Use the 50-30-20 Rule with an Indian Twist

You might have come across the 50-30-20 rule — 50% for needs, 30% for wants, and 20% for savings. On paper, it looks perfect. But let’s be real — in India, life doesn’t always fit into such neat boxes. Why? Because life here isn’t just bills and Netflix. It’s also weddings, Diwali shopping, birthday functions, pujas, and random “chanda” collections that pop up without warning.

So here’s how I look at it: make it 55-25-20.

Now, this isn’t about being rigid. Some months — like Diwali or Eid — your wants will shoot up. That’s fine. Just trim a little from elsewhere or plan a small “festival fund” in advance. The point is, with this Indian version of the rule, you’re not denying yourself joy, but you’re also not sacrificing your future. It’s balance — the kind that lets you enjoy today and feel secure about tomorrow.

Read my post : The 50-30-20 Rule: Budgeting Simplified for Indian Millennials

Step 3: Slash Food & Grocery Expenses Without Feeling Deprived

Food is easily one of the biggest expenses every month. And honestly, if you’re not careful here, save ₹10000 per month will feel impossible. But the good news? You don’t have to give up good food — just get smarter with it.

- Buy seasonal fruits and veggies. A simple example: mangoes in April cost half of what they do in November. Same with carrots, cabbage, and other winter veggies. Seasonal = fresh + cheap + tasty.

- Go local and bulk-buy smartly: Mandis, wholesale markets, and stores like D-Mart or Reliance Smart give you bulk discounts. The more you buy in one go, the lower your per-unit cost.

- Batch cook your meals: Making dal, sabzi, and chapatis in one go for a couple of days means less wastage, less temptation to order food, and ready-to-eat meals waiting for you.

- Cut down on eating out: Dining out once in a while is fine — but instead of going every week, make it twice a month. Right there, you’ve saved ₹3,000 or more without even trying.

- Use cashback & coupons: Grocery apps regularly give discounts, cashback, or coupons. A little extra effort here can stack up real savings.

- Ditch the small leaks: That ₹200 cold coffee, packaged chips, or soft drinks? They look small but add up fast. Cutting them down gives you extra hundreds every single month.

Bottom line: You don’t need to starve or live miserably. With small tweaks in how you shop, cook, and eat, you’ll slash thousands from your food bill without feeling deprived.

Step 4: Housing and Rent Hacks

If you’re living in a metro like Mumbai, Bengaluru, or Delhi, you already know rent can eat up half your salary before you even blink. But here’s the hack — you don’t always need to spend that much. Sharing a flat or staying in a PG can literally cut your rent in half. Even negotiating with your landlord (especially if you pay 3–6 months upfront) can shave off a nice little discount.

Another smart move? Don’t chase the “perfect” city-center flat. Living just 10–20 minutes away can reduce your rent by ₹3,000–₹5,000 every single month. That’s straight savings in your pocket without really compromising on lifestyle.

And if you stay in your own place, the trick is simple — don’t let your bills eat into your income. Switch off what you don’t use, avoid water wastage, and try energy-efficient appliances. Your electricity and water bills will drop without you even noticing.

End of the day, housing is one of the biggest expenses. But with a few tweaks, you can easily free up extra money — money that pushes you closer to save ₹10000 per month goal.

Step 5: Smarter Transport Choices

Travel is one area where money just slips out of our pocket without us noticing. If you’re in a metro city, public transport is your best friend — metros, trains, and buses are way cheaper than booking Ola or Uber every other day. And if you grab a monthly pass, you usually save even more.

For shorter distances, try walking or cycling. Not only do you save a neat ₹1,000–2,000 every month, but your health gets a bonus too (less doctor bills later). If you work in an office, carpooling with colleagues or using ride-sharing apps like Quick Ride can cut down costs big time. Keep cabs strictly for emergencies — otherwise, they’ll burn through your budget before you realize.

Even tiny changes in how you travel can add up. Instead of making five different trips in a week, just plan things together and do them in one go — saves both petrol and time. And if you drive, don’t just stop at the nearest petrol pump out of habit; apps can actually show you where fuel is cheaper nearby. These simple tricks can easily keep ₹1,500–2,500 in your pocket every month.

Step 6: Control Lifestyle Spending (Entertainment, Shopping & Subscriptions)

Honestly, lifestyle expenses feel tiny when you swipe — but together they eat up a big chunk of money. A Netflix or Hotstar subscription here, a random online order there, or that “just one weekend treat” — it all adds up before you even notice.

I handle it by keeping only one OTT subscription active at a time. Watch everything on that, then pause it and switch to another platform later. You enjoy all shows, but you don’t keep paying for three or four apps at once.

Shopping is one of those areas where it’s easy to slip. I don’t jump on every “sale” banner I see. Instead, I stick to a list of things I genuinely need and just wait for the big sale events — Flipkart’s Big Billion Days, Amazon’s Great Indian Sale, or Myntra’s End of Reason Sale. That way, I’m buying what I already planned — just at a lower price — instead of wasting money on random impulse stuff.

Another small hack I follow is turning off promo notifications from Amazon, Flipkart, and even Swiggy. Honestly, those pop-ups are designed to make you spend. The less I see them, the less tempted I am to waste cash. Pool gifts with friends, or go for simple, homemade options. Trust me, people remember the thought, not the price tag.

In the end, once you start keeping an eye on these little lifestyle expenses, hitting that save ₹10000 per month target won’t feel like torture. After a while, you honestly won’t even think about the old spending habits.

Step 7: Handle Indian Social Obligations Smartly

In India, there’s no escaping social commitments — weddings, birthdays, pujas, and festivals will always be part of life. But the good news is, they don’t have to mess up your savings. What I do is set aside a fixed “social budget” every month (say ₹2,000) just for gifts and events, and I don’t cross that line. If it’s a group gift, I prefer pooling in with friends or relatives — it feels thoughtful without putting all the pressure on my pocket.

And honestly, learning to say “no” politely to over-the-top parties or trips has saved me a lot of money (and stress). I try to focus only on the occasions that really matter. For festivals, I keep it even simpler — I put away ₹1,000–2,000 every month in advance, so when Diwali or Eid comes around, the money’s already there.

With a bit of planning and straight talk with friends and family, you can honor traditions, be present for the people who matter, and still keep your savings goal on track.

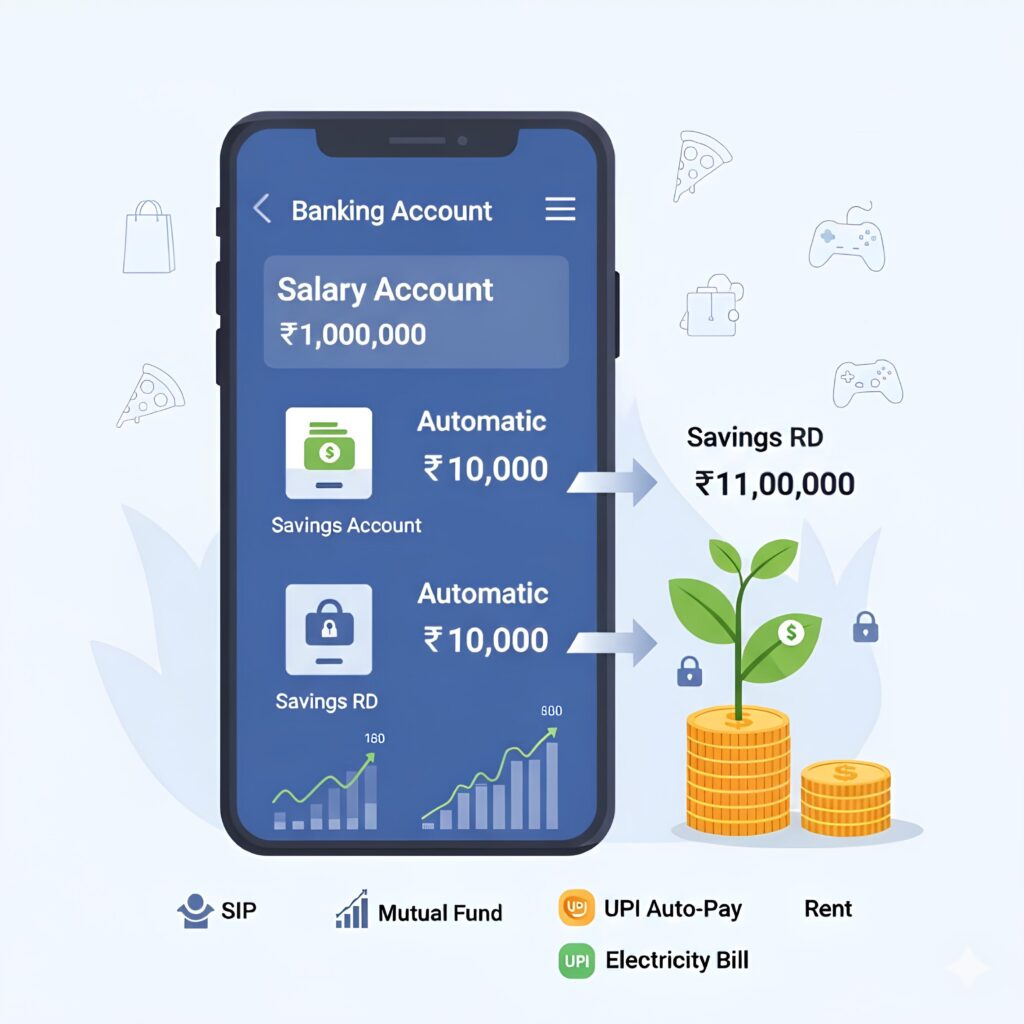

Step 8: Automate Your Savings

Here’s the thing — saving works best when you don’t give yourself the chance to think twice about it. The simple rule is pay yourself first. Instead of waiting till the end of the month to see what’s left, set up an auto-transfer of ₹10,000 from your salary account straight into a separate savings account or recurring deposit (RD) the same day your salary comes in.

Don’t let large sums of money sit idly in your main bank account—that’s a playground for impulse purchases.

Instead of letting big chunks of cash sit around, put them to work! Set up a few things—like UPI auto-pay for your bills or automatic investments—to handle things for you. Before you know it, saving ₹10,000 a month won’t be a struggle; it’ll just be second nature.

Real-Life Example: Salaried Employee in Bangalore

Let’s talk about Ravi. He’s your regular 9-to-5 guy in Bengaluru, pulling in ₹45,000 a month. Nothing flashy, just steady income and smart moves. Now, you’d think saving ₹10,000 every month on that salary sounds like a stretch, right? But Ravi’s cracked the code.

He splits a flat with roommates—₹12,000 for rent, sorted. Groceries and home-cooked meals? ₹8,000. No Zomato binges here, just good old dal-chawal and budget-friendly cooking. For getting around, he’s got the metro and bike pooling down to ₹2,000. Social life and festivals? He’s got a ₹2,000 pocket for that too—enough for a few outings and Diwali lights.

Entertainment and shopping? ₹3,000 cap. No impulse buys, no random online hauls. And here’s the power move: ₹10,000 goes straight into a mutual fund SIP every month. No drama, just auto-debit and chill. The rest—₹8,000—is for those random curveballs life throws at you.

Ravi’s not living like a monk. He’s just tuned into his money. With a bit of planning, some tracking, and letting automation do the heavy lifting, he’s turned saving into a habit. ₹10,000 a month isn’t just doable—it’s sustainable. And over time? That habit becomes wealth.

Psychological Hacks to Stay Consistent

Sticking to a savings plan isn’t just about math. It’s a full-on mind game. But once you learn the hacks, it’s like flipping a switch.

First up: go old-school with cash. When you physically hand over those ₹100 notes for chai or groceries, you feel it. Swiping a card or tapping your phone? Too easy, too invisible. Cash makes you think twice—and that’s the point.

Then there’s the 24-hour rule. You see something online, your finger’s itching to hit “Buy Now.” Pause. Wait a day. Chances are, that impulse fades and you’ll thank yourself for not buying another random gadget you didn’t need.

Now, let’s talk dreams. A vision board isn’t just arts-and-crafts—it’s your personal hype machine. That Goa trip, your dream car, a cozy home with a balcony garden? Keep it somewhere that catches your eye. It keeps your “why” front and center.

Finally, celebrate the wins. Saved ₹2,000 this week? Treat yourself to a guilt-free dosa outing. Hit the ₹10,000 mark for the month? Do a little dance, post it, brag a bit. Positive vibes make the habit stick.

Saving isn’t punishment—it’s power. And with these little mind tricks, you’re not just saving—you’re building a life you actually want.

Frequently Asked Questions (FAQs)

Buying a Car at the Wrong Time? Avoid This Costly Mistake in 2025

The Hidden Cost of Car Ownership Buying a car feels like a big moment. It’s…

Renting vs Buying a House with EMI: Wealth Choices for 2025

A house has always meant more than just four walls — it’s a symbol of…

Best Credit Cards in 2025: The Shocking Truth Banks Don’t Want You to Know

Everywhere you turn in 2025, banks are chasing your attention with flashy ads about the…

How Term Insurance Builds Millionaire Wealth in 2025

Introduction When most people talk about becoming rich, they instantly think of investments — stocks,…

Why Skipping Health Insurance Could Ruin Your Life in 2025– Global Healthcare Costs & Protection

Introduction I’ll be honest with you—I used to think health insurance was a scam. Every…

11 Money Traps That Keep You Poor (And How to Escape Them)

Are You Building Wealth — or Just Working Hard? There was a time when I…